For the 26 million unemployed and underemployed Americans, this economy has got to be mind-blowing. On one hand, the Shadow Government Statistics’ “Alternate Unemployment Rate” remained at 23 percent in January, its highest level ever.

On the other hand, the Dow Jones Industrial Average just zoomed past 14,000, hitting record highs.

In addition, Dean Maki, chief U.S. economist at Barclays, is quoted as saying: “As a percentage of national income, corporate profits stood at 14.2 percent in the third quarter of 2012, the largest share at any time since 1950, while the portion of income that went to employees was 61.7 percent, near its lowest point since 1966. In recent years, the shift has accelerated during the slow recovery that followed the financial crisis and ensuing recession of 2008 and 2009.”

So we have companies making record profits but they aren’t hiring. How can that be?

Federal Reserve Chairman Ben Bernanke recently claimed that his plan to buy $85 billion a month in Treasury and mortgage-backed securities would keep borrowing costs low.

But is that really the catalyst for job creation? Yes, businesses, especially small businesses, want to be able to borrow money at low interest rates so they can grow and hire. But with healthcare costs and taxes exploding and excessive regulations hindering growth, companies aren’t looking to spend money — they’re saving every penny to just keep the doors open and pay their current employees.

And now we have $85 billion in automatic spending cuts taking effect between now and Sept. 30 as part of the so-called federal budget sequestration. The sequester could reduce economic growth by at least half a percentage point and result in the loss of 700,000 jobs.

Yet these job losses are treated as an afterthought. The headlines are all about the minimal effect these cuts will have on the economy and on the stock market. Is this really the story? Or is it once again that job creation has fallen off the priority list?

It’s almost impossible to believe that in May 2012, the non-partisan Congressional Budget Office predicted that the unemployment rate would average 6.3 percent in 2016. And last week, Bernanke reiterated that unemployment probably would reach the 6 percent level during 2016. This is pure fantasy.

The Obama administration continues to trot out their carefully constructed, utterly understated 8.0 percent unemployment number. Unemployment is significantly higher as millions of Americans have given up hope and stopped looking.

According to The Huffington Post, “Over the last three years, nearly 5 million U.S. workers have effectively gone missing. In January, the percentage of Americans who were either employed or actively looking for work fell to 64.2 percent, which does not include some 4.9 million Americans who were left out of the Department of Labor’s official unemployment count because they are too discouraged to continue seeking work.”

This data is manipulated and the number is much higher, but even accepting that figure — a group larger than the population of Los Angeles — is an indictment of this administration’s ability to help the private sector create jobs.

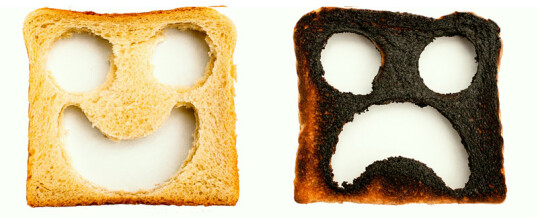

I touched on this problem earlier. When companies are nervous, they don’t hire. And today’s companies are worried that the U.S. government is out of solutions for growing the economy so people can get back to work. It’s a bipolar economy.

The Mayo Clinic writes that: “Bipolar disorder requires lifelong treatment, even during periods when you feel better.”

That pretty much sums up our bipolar economy. Our economy requires lifelong treatment even during periods when we feel better. While we feel better that corporate profits and the Dow are soaring, our employment picture has got us panicked.

Come to think of it, wouldn’t an army of psychiatrists make a world of difference on Capitol Hill?

MAR