Seton Motley, executive director of Less Government, was a guest recently on my Made in America radio show, and he maintained that American trade policies, especially subsidies, are ripping off taxpayers and boosting the price of food in the U.S. and around the world.

He contends that governments raise the prices of everything we try to buy. They do so indirectly — via hidden costs of government we can’t clearly see. As a result of subsidies and tariffs, the United States has to grapple with $1.8 trillion that is added to the cost of everything we make — including everything we try to sell to the rest of the planet. This includes the cost increase in the food sector that ultimately makes it harder for people around the world — many of them in abject poverty — to afford food.

Just this past October, Mexico and the United States avoided a trade war over sugar that would have placed steep duties on Mexican sugar imports to the United States.

According to Reuters, the U.S. sugar industry producers filed a suit accusing Mexican mills of flooding cheap, subsidized sugar into the U.S. market and at a cost of nearly $1 billion in net income in 2013 and 2014.

This came about because the Department of Commerce had recommended anti-subsidy duties on Mexican sugar that could have incurred dumping penalties for Mexican sugar ranging from 39.5 percent to 47.3 percent.

As in most trade agreements involving subsidies, there are winners and losers. In this case, while America gained concessions, Mexico had to agree to a set price for its sugar, despite the fact like the rest of the world, Mexico’s sugar mills are struggling to break even with prices near the cost of production amid four back-to-back years of surplus. When the Mexican economy suffers, it punishes the Mexican people and starts the flow of illegal aliens to the U.S.

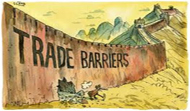

While this is one example of the perils of subsidies, Motley proclaimed that we are in a “regulatory arms race” with the rest of the world. Every time we add new subsidies for American goods, other countries raise tariffs. Then we increase subsidies, and other countries raise tariffs again. The worst part is that American taxpayers are actually paying for programs that increase the price of our own goods, including food.

Motley wants to see the government stop picking the favorite products to support since they have no idea what they are doing, and wind up punishing everyone.

Setting artificial arbitrary prices for goods results in consumers paying too much. And as we have seen in America, it hurts every American taxpayer.

The U.S. government and the governments of other counties should stay out of the export and import process. In most cases, subsidies are merely a form of corruption and cronyism that rewards the few at the expense of the many. But this seems more and more unlikely because there is too much money involved, even as it keeps the majority of people in third world countries in poverty.

That’s why, as a compromise, it’s time to create the Department of Global Commerce, headed by a Secretary of Global Commerce who has extensive experience in international business.

Then we must give this department the ultimate power in making trade policy recommendations to the president. All agencies focused today on commerce and trade would be consolidated into the Department of Global Commerce.

The role of the Secretary of Global Commerce would be substantially different from the current role of the U.S. Trade Representative and the U.S. Secretary of Commerce. This cabinet member would preside over all trade policy discussions.

Global trade must be free of subsidies and high tariffs that punish the people who want and need the goods involved. When American exporters have unfettered access to foreign markets, everyone is a winner.

© 2014 Moneynews. All rights reserved.

Urgent: Should Obamacare Be Repealed? Vote Here Now!

NOV